Phillips Edison & Company (PECO)·Q4 2025 Earnings Summary

Phillips Edison Beats on Revenue, Core FFO Hits $0.66 as Grocery-Anchored REITs Thrive

February 6, 2026 · by Fintool AI Agent

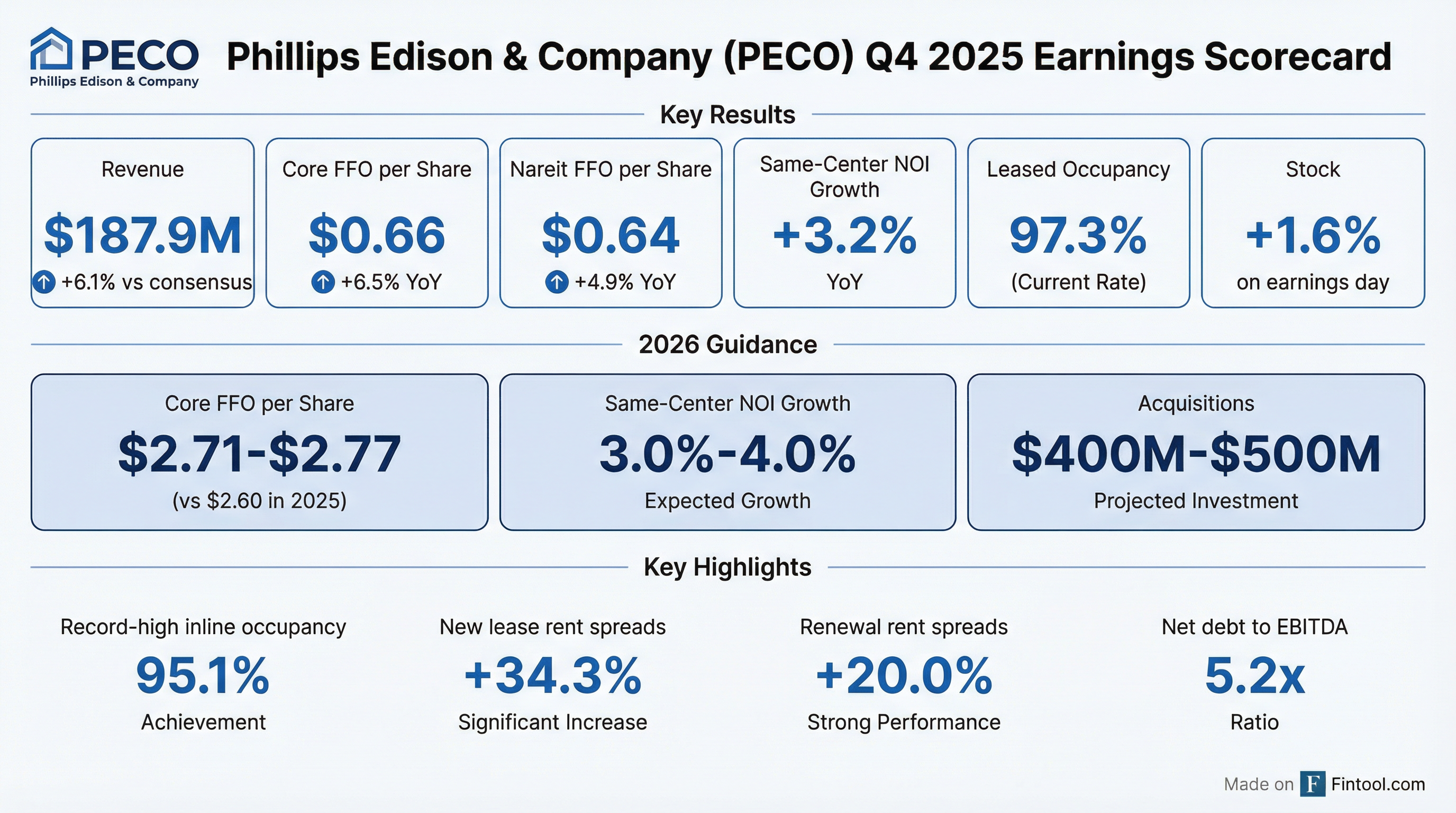

Phillips Edison & Company (NASDAQ: PECO), one of the nation's largest owners and operators of grocery-anchored neighborhood shopping centers, delivered a strong Q4 2025 with revenue beating consensus by 6.1% and Core FFO per share growing 6.5% year-over-year. The stock hit a new 52-week high on the news.

Did Phillips Edison Beat Earnings?

Yes — decisively on revenue, with solid FFO growth.

For the full year 2025, PECO delivered:

- Nareit FFO per share of $2.54 (+7.2% YoY)

- Core FFO per share of $2.60 (+7.0% YoY)

- Same-Center NOI growth of 3.8%

CEO Jeff Edison commented: "2025 was a strong year for PECO, and we enter 2026 with good momentum. Retailer demand remains strong for well-located, grocery-anchored shopping centers."

What Did Management Guide for 2026?

PECO issued strong 2026 guidance, consistent with their long-term targets:

Management's guidance implies mid-to-high single digit FFO growth, aligned with their long-term targets. The Same-Center NOI growth guidance of 3-4% reflects continued strong retailer demand for well-located grocery-anchored centers.

How Did the Stock React?

PECO rose 1.6% on earnings day, hitting a new 52-week high.

The stock has been in an uptrend since late January, with investors anticipating strong results. The 52-week high suggests the market is pricing in continued execution on the grocery-anchored thesis.

What Changed From Last Quarter?

Leasing Momentum Remains Strong

PECO's leasing activity continued to impress with full-year 2025 spreads well above historical averages:

The 95.1% inline leased occupancy is a record high for the company.

Transaction Activity

Q4 2025 acquisitions included:

- Bel Air Town Center (Baltimore suburb) — 78K SF

- Surprise Lake Square (Seattle suburb) — 133K SF, anchored by Safeway

Post quarter-end, PECO acquired $77M in additional assets:

- The Village at Indian Wells (Palm Springs) — Sprouts-anchored

- Creekside Park Village Green (Houston) — H-E-B-anchored

Tariff Risk: PECO Among the Lowest Exposed Retail REITs

One of the key investor concerns heading into 2026 is tariff exposure. PECO's grocery-anchored tenant mix positions them favorably:

The low exposure is driven by PECO's focus on:

- Grocery/pharmacy/liquor (28% of ABR) — 23% COGS imported

- Restaurants (20% of ABR) — 18% COGS imported

- Personal services (17% of ABR) — 0% COGS imported

- Medical (9% of ABR) — 20% COGS imported

This positions PECO among the retail REITs least exposed to tariff-related tenant stress.

Grocer Health: Sales PSF at Record Levels

PECO's grocery anchor thesis continues to perform:

The 2.3% grocer health ratio (rent + expenses as % of sales) gives PECO significant pricing power while keeping grocers profitable. 83% of ABR comes from the #1 or #2 grocer by sales in their respective markets.

National grocery foot traffic continues to grow, reaching 17.7 billion visits in 2025, up from 17.2B in 2024 and well above pre-pandemic levels of 15.5B in 2019.

Everyday Retail: New Growth Lever

PECO is expanding beyond grocery-anchored centers with their "Everyday Retail" strategy:

This strategy targets ~50,000 identified Everyday Retail centers across the U.S. with strong median household incomes, density, and high traffic near leading grocers.

Key Metrics Deep Dive

Portfolio Statistics

Balance Sheet Health

The slight uptick in leverage from 5.0x to 5.2x reflects acquisition activity. With $925M of liquidity and 85% fixed-rate debt, PECO is well-positioned to execute on their $400-500M acquisition guidance for 2026.

Management Commentary Highlights

On 2025 Performance:

"We are pleased to report strong 2025 results, which reflect Nareit FFO per share growth of 7.2%, core FFO per share growth of 7%, and same-center NOI growth of 3.8%." — Jeff Edison, CEO

On 2026 Outlook:

"While the market may continue to be nervous about the health of the consumer and the impact of tariffs on retailers, our outlook remains unchanged. As it relates to PECO's neighbors and grocers, we continue to feel very good about our portfolio. We are seeing a resilient consumer." — Jeff Edison, CEO

On Long-Term Growth:

"Looking beyond 2026, we continue to believe that PECO can consistently deliver 3%-4% same-center NOI growth and achieve mid to high single-digit core FFO per share growth on a long-term basis." — John Caulfield, CFO

On Investment Thesis:

"We will continue to drive more alpha with less beta." — Jeff Edison, CEO

Top Tenants by ABR

PECO's grocery anchor concentration provides stability:

95% of ABR comes from omni-channel grocery-anchored shopping centers.

Capital Projects Update

PECO has $69.5M in active development and redevelopment projects with attractive yields:

These projects provide superior risk-adjusted returns with a meaningful impact on NOI growth.

Technology Leadership: Fourth Consecutive AI Award

PECO continues to differentiate through technology innovation:

- Won the 2025 Digie Award for "Best Use of Artificial Intelligence" at the Realcomm Conference

- Fourth consecutive year winning this award

- Developed in-house AI tools using generative AI, machine learning, and predictive analytics

- Cross-functional processes designed to foster AI collaboration across departments

This technology-forward approach enhances operational efficiency and positions PECO as a leader in commercial real estate innovation.

Q&A Highlights

Acquisition Pipeline Accelerating

Bob Myers noted that deal flow has surged: "In 2026, we've already seen about a 70% increase in the opportunities that we're looking at and about a 67% increase in the deals that we've underwritten."

The company underwrote 50% more deals in 2025 vs 2024 and presented double the number to investment committee.

Occupancy Upside Potential

Management sees room for further improvement despite already-high occupancy:

Bob Myers: "I don't see it slowing down. There's no new supply. Retailer demand and our necessity-based focus has been very positive."

Amazon Fresh Struggles

Jeff Edison on Amazon's brick-and-mortar challenges: "Amazon Fresh is closing their stores. It's not a surprise to us... They really have had a tough time with bricks-and-mortar retail. Over 80% of grocery delivery is done from the store. How do they make it work when you don't have the store footprint that a Kroger has, that a Walmart has?"

Everyday Retail Performance Exceeding Targets

The 9-property, ~$180M Everyday Retail portfolio is outperforming:

Bob Myers: "We are above 11% [unlevered returns]. That's the benefit of the strategy as we continue to use our operational expertise to remerchandise and create value long-term."

Bad Debt Stable

John Caulfield on bad debt: "We finished this year around 78 basis points... The fourth quarter was a little elevated, but ultimately, still very consistent with what we've seen this year and what we expect in 2026."

Credit Rating Opportunity

CFO John Caulfield believes PECO is an underrated credit: "When we compare our leverage level compared to our peers, we have the same leverage metrics or better in some cases than they do. The rating agencies at this point are more focused on scale."

Current 10-year debt would price around 5.25%. A credit upgrade could yield ~25 bps improvement per notch.

JV Capital Available

The Cohen & Steers JV is "well equipped with capital to continue to take advantage of market opportunities." One fund is close to being fully invested with 1-2 more deals under contract.

Ocala Development Update

The Ocala, FL development (one of the nation's fastest-growing markets with 10,000 new homes within 5 miles) is progressing:

- Grocer expected to spin off mid-year

- 7 out-parcels being marketed for ground lease

- Targeting unlevered returns above 9.5-10%

Capital Funding Strategy

John Caulfield on funding the 2026 plan:

- Free cash flow after distributions: $120M+

- Development allocation: ~$70M

- Dispositions: $100-200M

- Debt markets: 1-2 bond offerings planned, opportunistically timed

- Liquidity: $925M+ available

Key Risks and Watchpoints

- Leverage uptick: Net debt/EBITDA increased from 5.0x to 5.2x with acquisition activity

- Slight occupancy decline: Leased occupancy dipped 40 bps YoY to 97.3%

- Interest rate sensitivity: 15.3% of debt is variable rate

- Tariff/macro concerns: Forward-looking statements cite tariff and trade disruption risks

- Bad debt: Q4 elevated slightly but expected to remain around 78 bps in 2026

Forward Catalysts

- Q1 2026 earnings call (early May) — First full quarter under 2026 guidance

- Acquisition pipeline — $400-500M target for 2026

- Rent spread momentum — Watch for continued 20%+ spreads

- 10-K filing — Expected around February 10, 2026

Summary

Phillips Edison delivered a strong Q4 2025 with revenue beating consensus by 6.1%, Core FFO growing 6.5% YoY, and record inline occupancy of 95.1%. The earnings call reinforced management's confidence: deal flow is up 70% YTD, the Everyday Retail strategy is generating 11%+ unlevered returns (vs 10% targets), and inline occupancy has 100-150 bps of additional upside potential.

Management's "more alpha with less beta" mantra encapsulates the thesis: grocery-anchored, necessity-based retail offers defensive growth with meaningful upside from rent spreads, occupancy gains, and disciplined capital recycling.

Related Links: